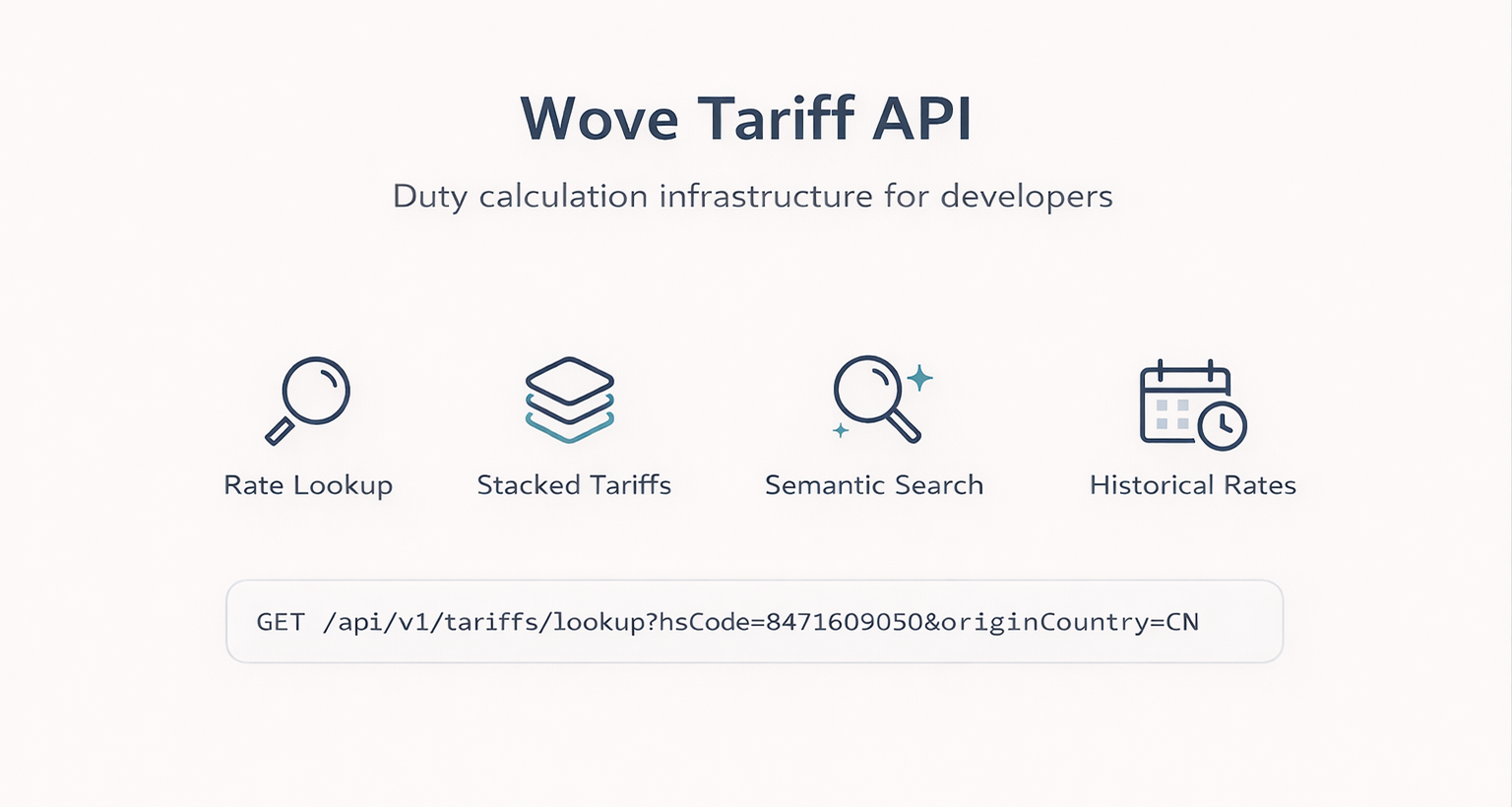

We're making Wove's tariff calculation engine available as a standalone API. If you're building landed cost estimators, procurement tools, quoting systems, or trade compliance software, you can now embed duty rate lookups and tariff calculations directly into your application.

What It Does

The Tariff API handles the complexity of modern trade policy so your application doesn't have to.

Duty rate lookup - Query by HS/HTS code and get current rates for US, EU, Canada, and Australia. Returns MFN rates, preferential rates, and additional duties (Section 301, 232, IEEPA, etc.) with a single request.Stacked tariff calculation - Automatically calculates combined duty impact when multiple tariff programs apply to the same product. If you're importing aluminum components from China, the API returns Section 232 + Section 301 + any applicable IEEPA rates, not just the base MFN rate.Semantic search - Don't know the HS code? Search by product description using natural language. "laptop computer" returns ranked HTS codes with similarity scores so you can classify products programmatically.Historical rates - Look up what tariff rates were on any past date. Critical for refund calculations, audit preparation, or analyzing how policy changes affected your costs.FTA eligibility - Specify origin and destination countries to see available free trade agreement rates and calculate duty savings from preferential programs.Why We Built This

2025 saw 50 modifications to the U.S. tariff code—half from emergency economic powers (IEEPA) that are now under Supreme Court review. Companies building procurement systems, marketplace checkout flows, or ERP integrations kept hitting the same wall: tariff calculation is too complex to maintain in-house.

Rate lookups aren't enough. You need to know which additional duties apply, how they stack, whether exclusions exist, and what trade agreements might reduce the rate. And you need this to stay current as policy changes.

We built Wove's tariff engine to power our own landed cost calculations for freight forwarders and importers. We're now making it available as infrastructure that other platforms can build on.

What Makes Us Different

Policy-aware, not just data lookup - The API understands tariff program interaction. It knows that Section 232 steel tariffs apply based on component percentages, that Chapter 99 exclusions override base rates, and that certain products are subject to multiple overlapping tariff actions.Current by default - Rates update automatically as tariff schedules change. You don't maintain rate tables or parse Federal Register notices.Built for embedding - Clean REST endpoints, predictable response formats, and customer-specific overrides mean you can integrate this into quoting flows, procurement dashboards, or customs filing systems without building your own tariff infrastructure.Use Cases We're Seeing

Landed cost estimators - E-commerce platforms and B2B marketplaces showing buyers total delivered cost including duties at checkout.Procurement tools - Sourcing teams modeling tariff impact across supplier options to make China+1 decisions with actual cost data.Customs compliance - Brokers and freight forwarders automating duty calculation for entry filing and client invoicing.Financial planning - Finance teams running scenario analysis on tariff policy changes to understand P&L exposure.Getting Started

API documentation with full endpoint details, example requests, and authentication setup: https://api.wove.com/api/docs/

Tariff endpoints are at the bottom of the docs. If you want to test with your product catalog or discuss volume pricing, reach out.